Tax filing information for J-1 visa holders

Tax season is coming up, many J-1 visa holders may be confused. Should I report my taxes? What is the deadline? And How should I file it? Here is some information for our J-1 visa holders.

Who must file tax forms for the 2020 tax season?

If you earned any U.S. income between January 1 – December 31, 2020, you will need to file a federal tax return with the IRS (Internal Revenue Service) by law. Failure to file a Federal tax return will breach IRS regulations and may inhibit you from returning to the US on any future visas.

Depending on your individual circumstances, you may also need to file a state tax return(s). If you were physically in the U.S. in J-1 status anytime between January 1 – December 31, 2020, but had no income, you’re obligated to send one form, Form 8843, to the IRS.

When is the tax filing deadline?

April 15th, 2021 is the last day for residents and non-residents who earned U.S. income to file Federal tax returns for 2020. State tax returns date may vary. We strongly suggest you submit your tax return as soon as you can.

What is Resident or Non-Resident for Federal Tax Purposes?

Most J-1 Summer Work and Travel, J-1 Interns/Trainees, J-1 teachers, and J-1 Camp Counselor are considered non-resident for tax purposes. The above J1 visas are automatically considered non-resident for 2 out of the last 6 calendar years in the US. If you’ve been in the U.S. for longer than 2 years for the last 6 years period, the Substantial Presence Test will determine your tax residency.

Documents you may need for tax return

| Document | Description |

| ✔ Passport | |

| ✔ Visa/Immigration information, including form DS-2019 (J status) | |

| ✔ Social Security or Individual Taxpayer Identification Number (if you have one) | This is not needed if you had no income and the 8843 is the only form you have to file. |

| ✔ * W-2 | This form reports your wage earnings if you worked. If you had more than one employer, you should get a W-2 from each employer. It is issued by the end of January for the previous year. Make sure all employers from last year have an up-to-date address for you. |

| ✔ U.S. entry and exit dates for current and past visits to the U.S. | In addition to passport stamps, you can review or print your U.S.travel history here |

| ✔ * 1099 | This form reports miscellaneous income. Can be interest on bank accounts, stocks, bonds, dividends, earning through freelance employment |

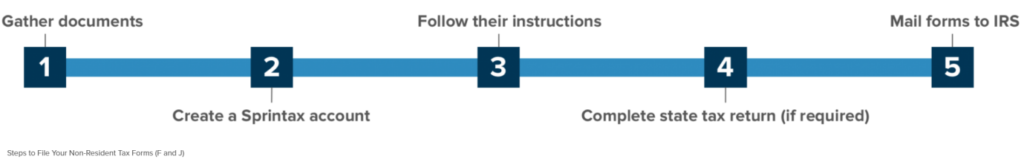

How to file?

Many of you may hear about TurboTax and other softwares that can be used for the tax return, but these softwares are mostly for U.S. residents. As most J-1 visa holders are considered non-residents, you should not use these softwares. We have teamed up with Sprintax to provide you with easy-to-use tax preparation software designed for Non-resident in the U.S.

After you login to Sprintax, it will ask you a series of questions about the time you have spent in the United States and in which immigration status, looking back over a period of years. Sprintax will then determine your tax status. If it determines that you are a “nonresident alien” (NRA) for federal tax purposes, you can continue to use it to respond to a series of guided questions. Sprintax will complete and generate the forms you need to print, sign, and mail to the IRS. If it determines you are a resident alien for federal tax purposes, you won’t be able to continue using the software. For more information, you can visit Sprintax’s website.

DISCLAIMER: Our organization is not qualified to assist with any tax form preparation or questions that require the guidance of a certified tax professional. The information provided is intended for your benefit. Any questions or concerns should be directed to Sprintax, a certified tax preparer or a local IRS field office.